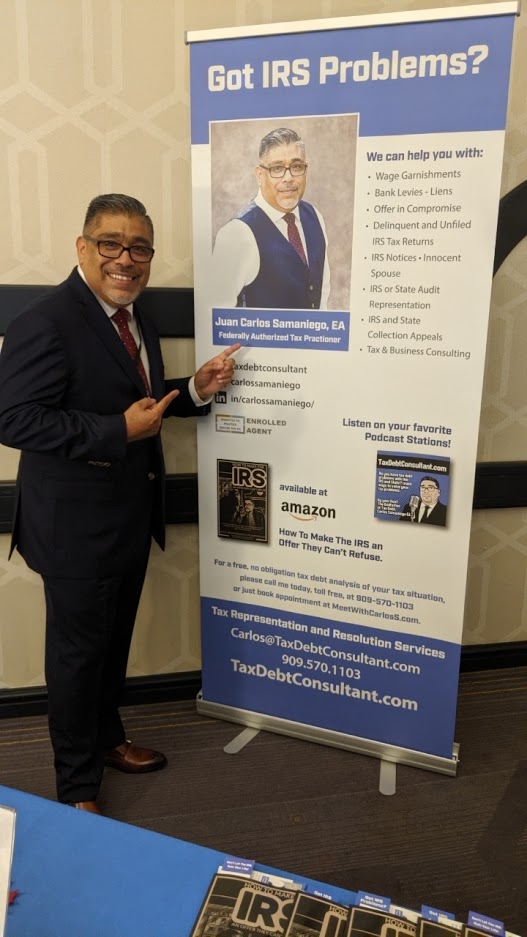

Don’t Let This Happen to You: A Real-Life IRS Horror Story That Could Have Been Avoided!

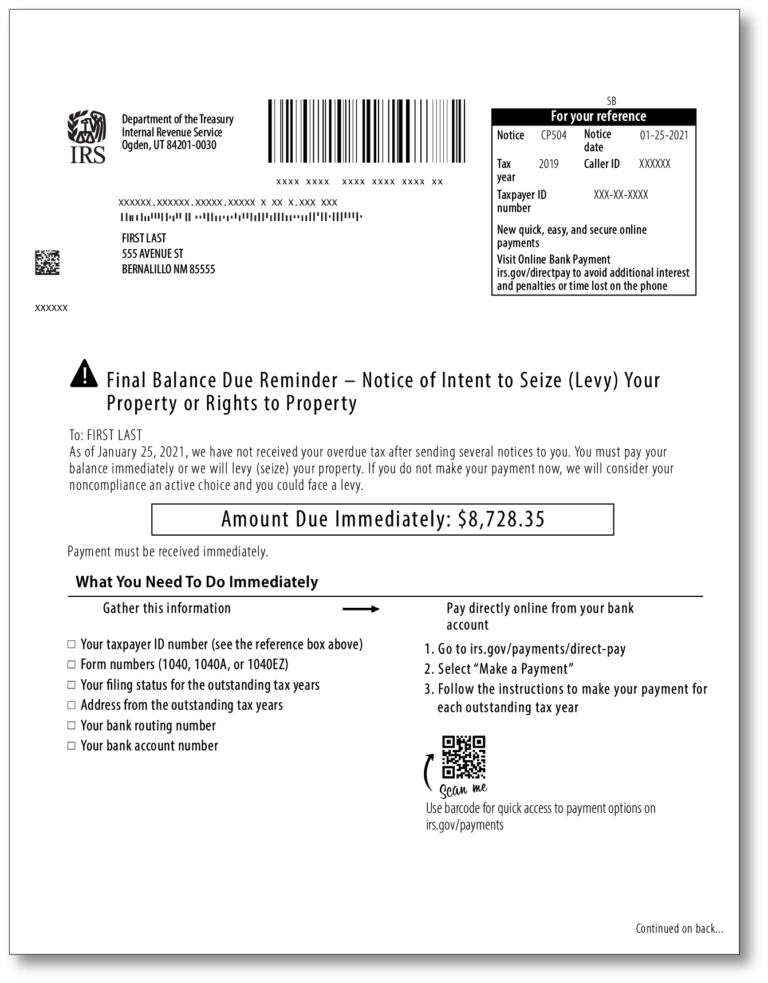

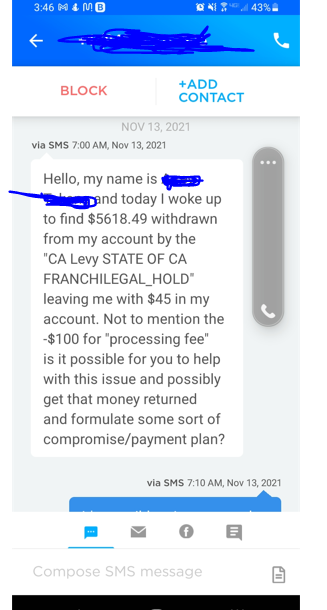

If you thought horror stories were just for campfires and Halloween, you haven’t met the IRS when you’re on their radar. But before I jump into my story. Now that…