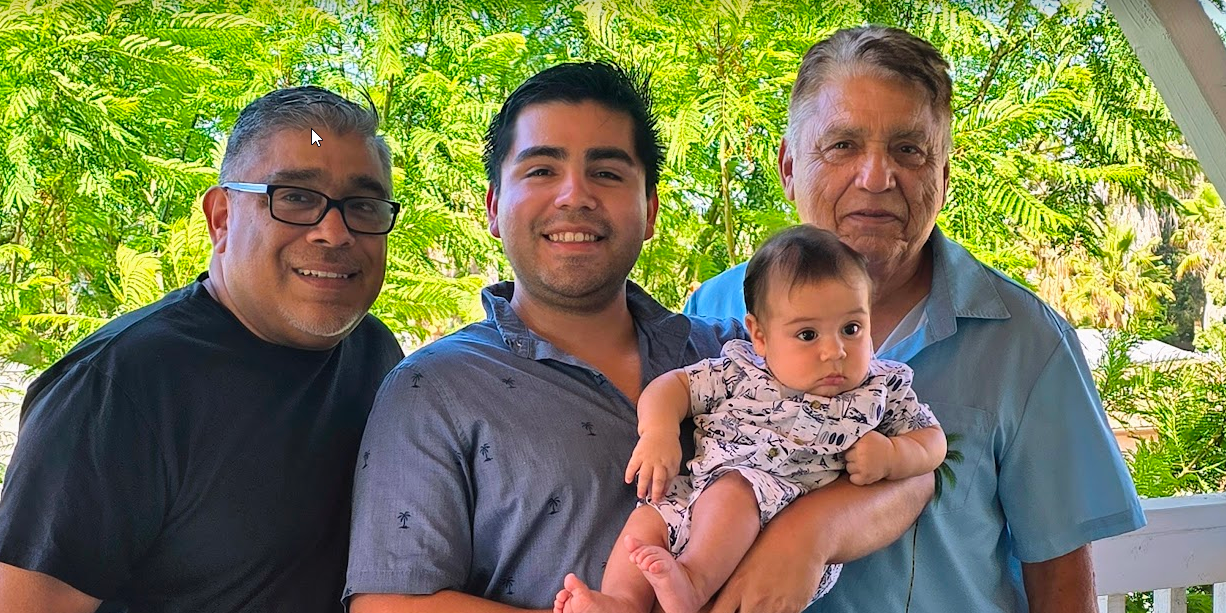

This past Sunday, I found myself in San Diego for an unexpected but deeply meaningful family reunion.

Three generations of tax professionals came together—my son, Andrew, my dad, Juan Orona, and me—to welcome the newest member of our family, my dad’s first great-grandchild.

Seeing my dad hold his great-grandson for the first time was a moment I’ll never forget.

But amidst the joy of family, our conversation inevitably turned to taxes (as it always seems to with three tax pros in one room!).

My son, Andrew, shared a story about a client who couldn’t understand why the IRS rejected his claim of nearly $2,000 in credit card debt as an allowable expense.

It struck me how many people are blindsided by what the IRS deems “necessary” when it comes to settling your tax debt.

You see, many folks don’t realize the IRS has a strict list of allowable expenses, and if it’s not on their list, it doesn’t count—no matter how essential it seems to you.

They expect their money first, before anything else.

Here’s the brutal truth:

- Credit Card Debt Payments: The IRS doesn’t allow credit card payments as an expense when negotiating your tax liability. They expect their money first.

- Tithes or Charitable Donations: You might feel good about your charitable giving, but the IRS doesn’t consider these necessary when you owe them. No deductions here.

- Luxury Items and Services: That boat, high-end car, or vacation home? The IRS won’t let you include payments for these in your expense calculations.

- Private School Tuition: Unless your child has special needs, private school tuition isn’t an allowable expense. The IRS expects you to stick to the basics.

- Voluntary Retirement Contributions: Contributing to your 401(k) is smart for the future, but the IRS isn’t interested in your retirement when you owe them now.

- Loans for Non-Essential Assets: Paying off that RV or vacation home? The IRS considers these luxuries and won’t count them as necessary expenses.

- Expensive Hobbies or Extracurricular Activities: Your golf club membership or your kid’s expensive extracurricular activities? Not necessary, says the IRS.

- Life Insurance Premiums (Beyond Term Life): Whole life or universal life insurance premiums don’t count. The IRS only considers term life insurance necessary.

- Cosmetic Surgery or Non-Essential Medical Treatments: Unless it’s a necessary medical expense, the IRS won’t allow it.

- Luxury Living Expenses: The IRS has a standard for what they consider a reasonable cost of living. If you’re living beyond that, they’ll expect you to downsize.

If you’ve received that dreaded Final Notice—Letter 11 from the IRS—understand that you’ve got less than 30 days before levies start hitting your bank accounts, paychecks, and more.

You can’t afford to guess wrong about what the IRS will or won’t accept.

So, what’s the next move?

You need to act now.

Don’t wait until the IRS is breathing down your neck.

Let’s get on a call and figure out what’s actually allowed and how you can protect yourself from what’s coming next.

To your financial freedom,

Carlos “Stop the IRS” Samaniego, EA

TaxDebtConsultant.com

909-570-1103 We answer 24/7

[Link to Book a Consultation]

P.S. Don’t let the IRS take more than they should. Let’s make sure your money stays where it belongs—right in your pocket.