I hope this message finds you in good spirits.

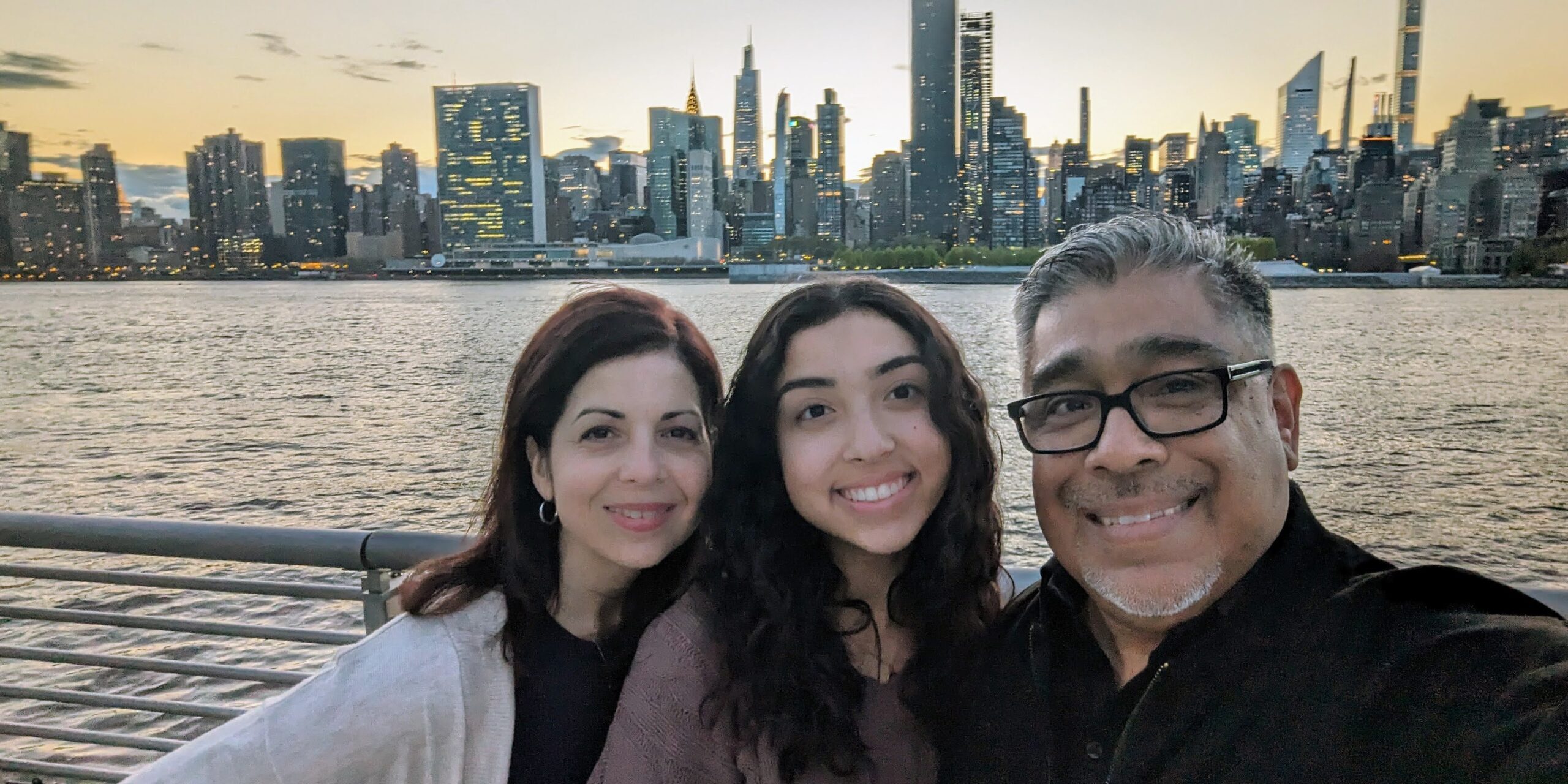

Our family on Sunday, just returned from a whirlwind trip to the East Coast with my daughter Bella.

We had a jam-packed schedule—meeting clients, interviewing podcast guests, and most importantly, visiting three of our nation’s premier military academies.

And yes, it was also a special moment as Bella was selected as a candidate for the Candidate Visit Weekend and we dropped her off at the US Naval Academy.

Let me share a bit about our first day.

We boarded a redeye that took off at midnight and landed us into JFK around 8 AM.

It was one of those flights where you try to sleep, but really, you’re just kind of lying there with your eyes closed.

Once we landed and got settled into our hotel in Queens, which had a stunning view of Manhattan, Bella and I took a moment just to soak it in.

It’s a view that’ll stick with her forever.

Now, onto the meat of our trip.

We visited the US Merchant Marine Academy and West Point for the first time, and then we headed to Annapolis—a place that’s become like a second home—to check in at the Naval Academy.

I’ve got to tell you, the level of precision and discipline at these institutions is nothing short of awe-inspiring.

I’ll be diving deeper into each visit in the emails to come, so keep an eye out.

During our stay in Annapolis, we also had the incredible opportunity to have lunch with a close friend who is not only a Naval Academy graduate but a retired Rear Admiral.

He’s one of the most amazing people I personally know, and his insights into leadership and strategic thinking are profoundly impactful.

You’re probably wondering, “Carlos, what do military academies and a lunch with a Rear Admiral have to do with my battles with the IRS?”

Well, it’s all about strategy and precision.

Think about it: these young cadets are groomed to handle complex operations with absolute precision, something absolutely essential when you’re up against the IRS.

Just like these cadets don’t head into a mission without a detailed plan and a seasoned leader, you shouldn’t face your tax problems without a solid strategy and a professional guide.

Why approach taxes like a military operation?

Because success in both fields requires careful preparation and a tactical approach.

Without it, you’re just reacting, always a step behind, like entering a battlefield totally unprepared.

Total disaster, right?

During my visit, I was particularly struck by the Naval Academy’s “Center for Academic Excellence.”

It’s a whole facility dedicated to ensuring no midshipman falls behind, providing targeted help to those facing academic challenges.

It made me think: shouldn’t everyone struggling with the IRS have the same level of support?

Imagine having a seasoned tax pro, someone who specializes in IRS challenges, right there in your corner—guiding you, strategizing with you, and spotting those hidden tax traps before they can catch you unawares.

Think of it as having your own tax general or Admiral!

Here’s My Offer:

Let’s kick this off with a free consultation.

No charge.

We’ll sit down, assess your situation, and start crafting a battle plan.

You’ve got nothing to lose and everything to gain.

Book your slot at CallTaxEA.com or give us a call at 909.570.1103.

Discipline and strategy aren’t just vital for the military; they’re crucial in managing your taxes too.

Let’s get you prepped and ready to tackle your IRS issues with the precision of a West Point cadet or Navy Academy Midshipman.

Are you ready to take charge?

Drop me a line, and let’s start this mission.

Looking forward to our chat,

Carlos Samaniego, EA

909-570-1103

TaxDebtConsultant.com

P.S. Next time, I’ll tell you why my wife burst into tears as we drove through the gates of the US Merchant Marine Academy. It was a moment that took us both by surprise and I think it’ll touch you too.