Are you a non-filer? Do you know what that means? It means that you have not filed a federal income tax return for a given year, even if you were required to do so.

The penalties for not filing can be steep, including fines and even criminal prosecution. But there is hope!

If you’re a non-filer, there are two ways to come clean with the IRS: through the voluntary disclosure program or by filing your missing returns.

The voluntary disclosure program is an agreement between the IRS and the taxpayer in which the taxpayer admits guilt and agrees to pay any back taxes, penalties, and interest. This program is usually the best option for those who have not filed because they owe taxes but have not been caught yet. The penalty for voluntarily disclosing is generally lower than the penalty for getting caught without disclosing.

Filing your missing returns is another option for those who have not filed. This option is best for taxpayers who do not owe any taxes or who only owe a small amount. The penalty for filing late is generally lower than the penalty for not filing at all, but it’s important to note that there is no guarantee that the IRS will not pursue criminal charges.

If you’re a non-filer, it’s important to come clean as soon as possible. The penalties only get worse the longer you stay out of compliance. The IRS offers two programs to help taxpayers come into compliance: the voluntary disclosure program and filing missing returns. Contact an attorney today to find out which option is best for you.

If you would like to speak with us to see what are your best options regarding your non-filing.

Do you have unfiled tax returns. We can help!

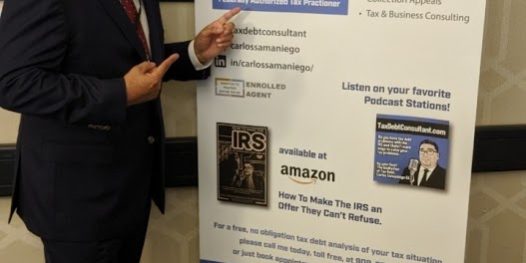

You can book an appointment right now to speak with Carlos at CallTaxEA.com or call us direct at 909-570-1103.

Learn more about us at TaxDebtConsultant.com