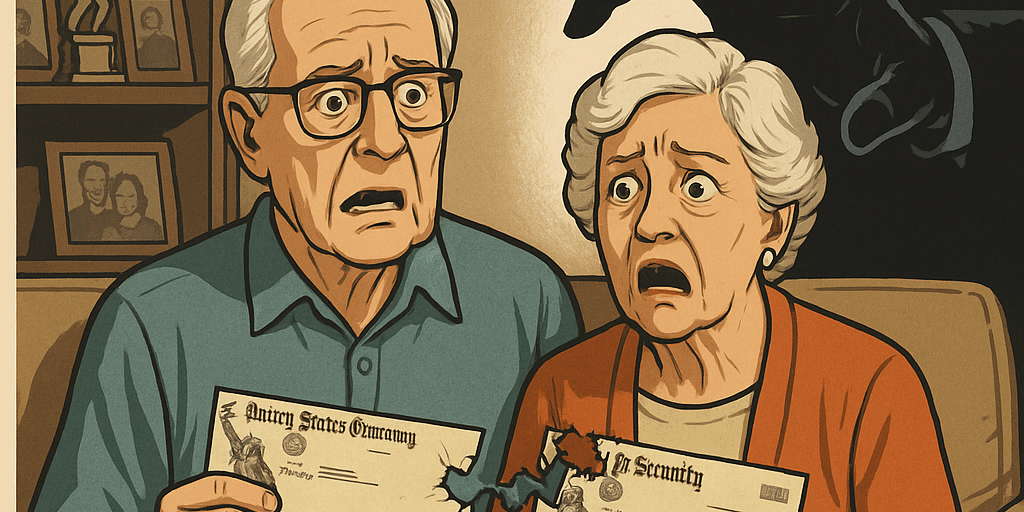

Retirement should be all about shuffleboard, grandkids, and sweet, sweet freedom. But guess what? The IRS didn’t get the memo. They’re still lurking, ready to claw away at your Social Security check like it’s a prime rib at a Vegas buffet.

The scary part? They don’t even need a judge’s permission to do it. Thanks to a little-known weapon called the Federal Payment Levy Program (FPLP), the IRS can swipe up to 15% of your Social Security benefits if you have unpaid tax debt. No courtroom drama, no drawn-out legal fights—just cold, hard garnishments.

The Reality for Retirees

Here’s the brutal truth: seniors are getting blindsided left and right. Most of them figure, “Hey, I’m retired. No job. No problem.” But that’s a costly mistake. Old tax debts (sometimes decades old!) can boomerang right back at you, and before you know it, the IRS is reaching into your pocket every month.

Here’s how it goes down:

✅ You stop working, but you’ve got unpaid taxes from way back.

✅ You miss a few IRS letters (because, let’s be real, those notices read like stereo instructions).

✅ Suddenly, BAM—your Social Security check is short by 15%.

How to Stop the IRS from Nibbling Your Nest Egg

Here’s the good news: there’s a way out. You don’t have to stand by and watch your retirement income shrink. The IRS offers real programs that can stop or reverse the garnishment—if you know how to navigate the red tape.

Some of the heavy hitters:

-

Installment Agreements: Set up monthly payments you can actually afford.

-

Currently Not Collectible (CNC) Status: Prove you’re in hardship, and collections hit the brakes.

-

Offer in Compromise: Wipe out tax debt for pennies on the dollar—legally.

-

Penalty Abatement: Say goodbye to sky-high penalties that piled up like bad reality shows.

Here’s the rub: The IRS isn’t going to send you a cozy invitation to these programs. You have to fight for it. And that’s where we come in.

We’re Tax Debt Consultant, and We’ve Got Your Back

At Tax Debt Consultant, we’ve helped seniors nationwide stop IRS collections in their tracks—and we’re not talking about some cookie-cutter solution. We tailor our strategies to your fixed income and your real-life challenges.

-

We’ll help you set up payment plans.

-

We’ll sort out unfiled returns.

-

We’ll stand between you and the IRS.

-

We’ll do it with compassion and the urgency it deserves.

Because you’ve got better things to do in retirement than wrestle with tax collectors.

Your Next Step—Act Before the IRS Takes More

Let’s be crystal clear: the IRS isn’t going to wait around while you “think it over.” If they’re garnishing your Social Security, you’re already on the clock. And if they haven’t started yet, they could at any moment.

Don’t wait for them to take another bite of your retirement. Don’t let confusion or fear hold you back.

Call us today at 909-570-1103 or book your free consultation at CallTaxEA.com. Let’s stop the IRS cold and keep your Social Security safe and sound—where it belongs.