Day 7: Seven Swans-a-Swimming through IRS Notices

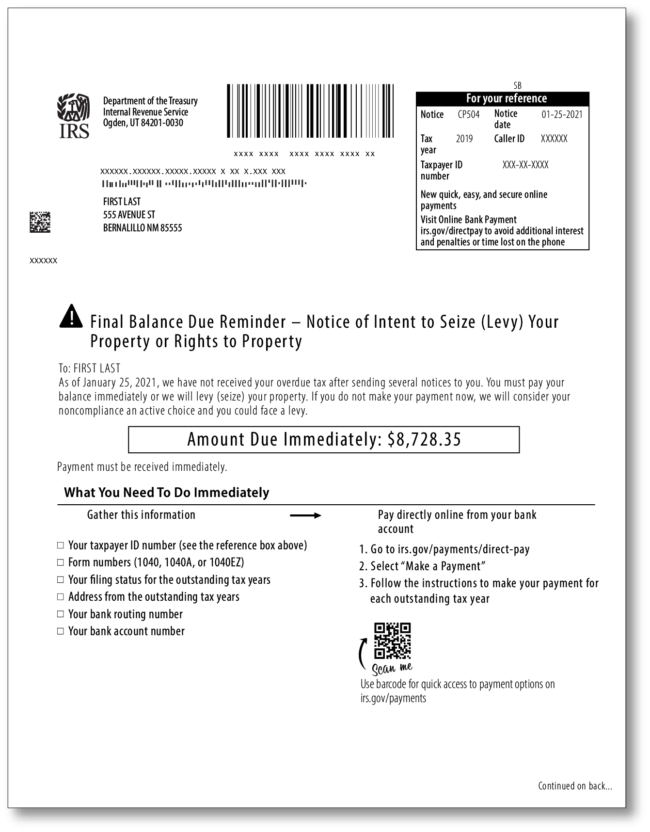

Yesterday ,we paddle through the seventh day of our 12 Days of Christmas Tax Resolution journey, I’ve got a tale to share, fresh from the swanky world of tax resolution. Today marked the commencement of the 3rd annual Tax Resolution Conference, graciously hosted by my good friend and Tax Attorney extraordinaire Eric Green. Picture this:…